Introduction

We provide end-to-end compliance services for businesses, professionals, and employers across India. Our work focuses on legal registrations and tax filings that are mandatory under Indian law. Many clients approach us for a shop and establishment license, e filing TDS, and to file ITR online without confusion or delay. These compliances are important for smooth business operations, employee management, and tax reporting. In this service guide, we explain each service in simple words and how we assist clients at every step.

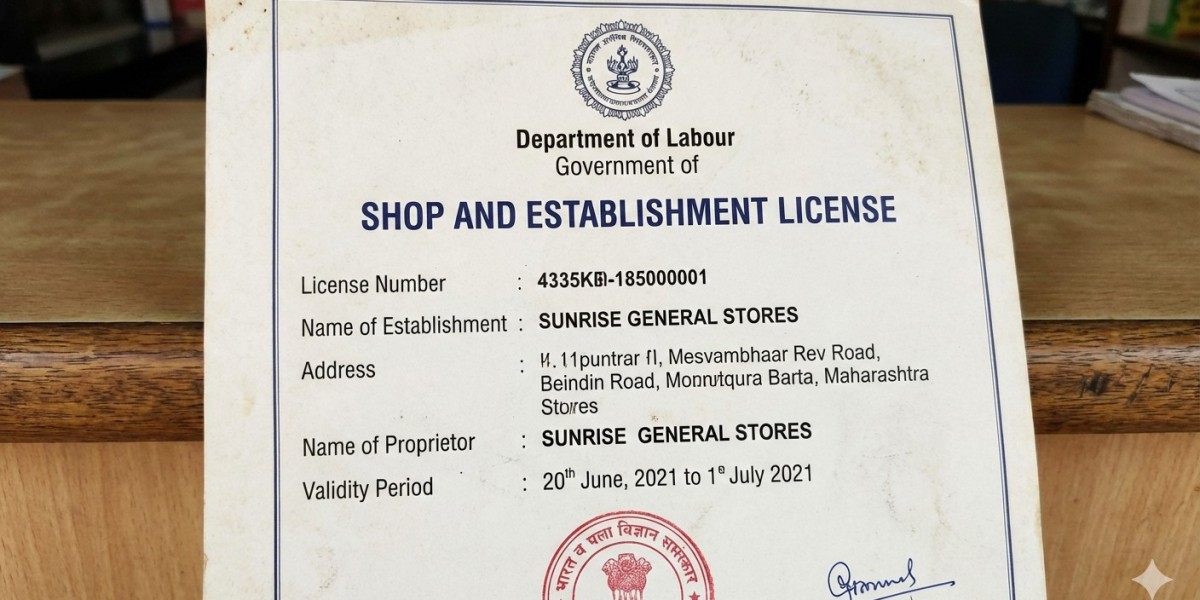

Shop and Establishment License Service

A shop and establishment license is required for most commercial premises such as shops, offices, hotels, and service centers. It is issued under the respective State Shop and Establishment Act and acts as proof of legal operation.

Why Shop and Establishment License Is Required

This license helps businesses follow rules related to working hours, employee welfare, holidays, and wages. It is also required for opening a current bank account, applying for GST registration, and other legal approvals.

Documents Required for Shop and Establishment License

To apply for a shop and establishment license, we usually collect:

PAN card of the business or owner

Address proof of business premises

Identity proof of owner or partners

Business incorporation proof

Employee details, if applicable

We verify all documents and submit the application on the state labor department portal.

Our Registration Process

We handle application filing, document upload, and follow-ups with the department. Once approved, we share the shop and establishment license certificate with the client. We also assist with renewal and amendment when business details change.

E Filing TDS Services

Tax Deducted at Source compliance is mandatory for businesses, employers, and professionals making certain payments. E filing TDS ensures that deducted tax is properly reported to the income tax department.

Who Needs to File TDS

TDS filing is required for:

Employers paying salary

Businesses making professional or contractual payments

Rent and commission payers

Non-filing or late filing may lead to penalties and interest.

Documents Needed for E Filing TDS

For e filing TDS, we require:

TAN number

PAN details of deductor and deductees

Salary or payment records

Challan details

Previous TDS return data

We check all figures carefully before preparing returns.

Our TDS Filing Support

We prepare TDS returns, validate data, and upload them on the official portal. If there is any error, we help with correction statements. We also assist in generating Form 16 and Form 16A for employees and vendors.

File ITR Online Services

Filing income tax returns on time is essential for individuals and businesses. We help clients file ITR online with proper income reporting and deductions.

Who Should File ITR

ITR filing is required for:

Salaried individuals

Business owners

Professionals and freelancers

Companies and firms

Filing returns helps maintain financial records and supports loan or visa applications.

Documents Required to File ITR Online

For smooth ITR filing, we collect:

PAN and Aadhaar card

Form 16 or salary details

Bank statements

Investment proofs

Details of other income

For business clients, financial statements are also required.

Our ITR Filing Process

We calculate taxable income, apply eligible deductions, prepare the return, and submit it online. We also assist with revised returns, refunds, and income tax notices.

Why Choose Our Compliance Services

Clients trust us because we provide clear guidance and handle compliance work professionally. We focus on correct documentation, timely filing, and transparent communication. Whether it is a shop and establishment license, e filing TDS, or file ITR online, we manage the entire process without unnecessary complications.

Complete Compliance Support Under One Roof

We offer multiple services so clients do not need to approach different consultants. From business registration to tax filings, we act as a single support system. We also remind clients about due dates to avoid penalties.

Conclusion

Legal and tax compliances are ongoing responsibilities for every business and taxpayer. With proper support, these tasks become easier to manage. We assist with shop and establishment license, e filing TDS, and file ITR online services to ensure that clients remain compliant and focused on their business growth.